Off to a Smart Start

Earn $1001 when you open a Smart Start Banking account and apply for the $2,500 Smart Start Scholarship4 by March 31, 2026.

Explore Our Products & Services

Certificates of Deposit with Competitive Rates

Compare our Checking Account Options

Saving for Your Future

Our savings accounts span every need, from setting aside cash to saving for college or retirement

Banking for Wherever You Are

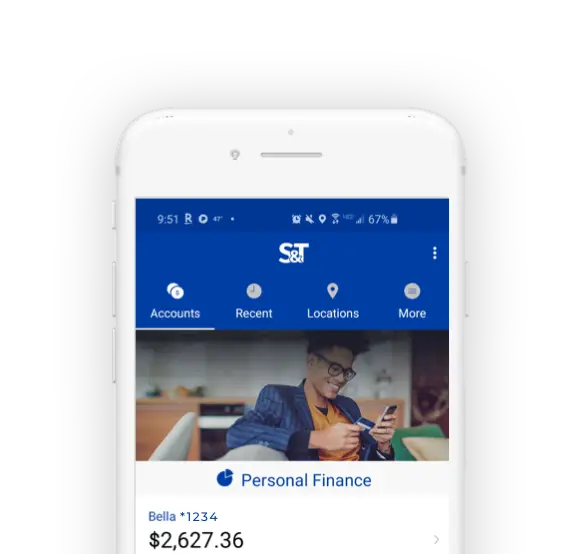

Mobile & Online Banking

Banking, Your Way

The S&T Bank Mobile App provides all the features of online banking on your mobile device – check balances, pay bills or people, and transfer funds between S&T accounts.

- View a snapshot of account balances

- Transfer funds between S&T accounts

- Pay bills and manage payees

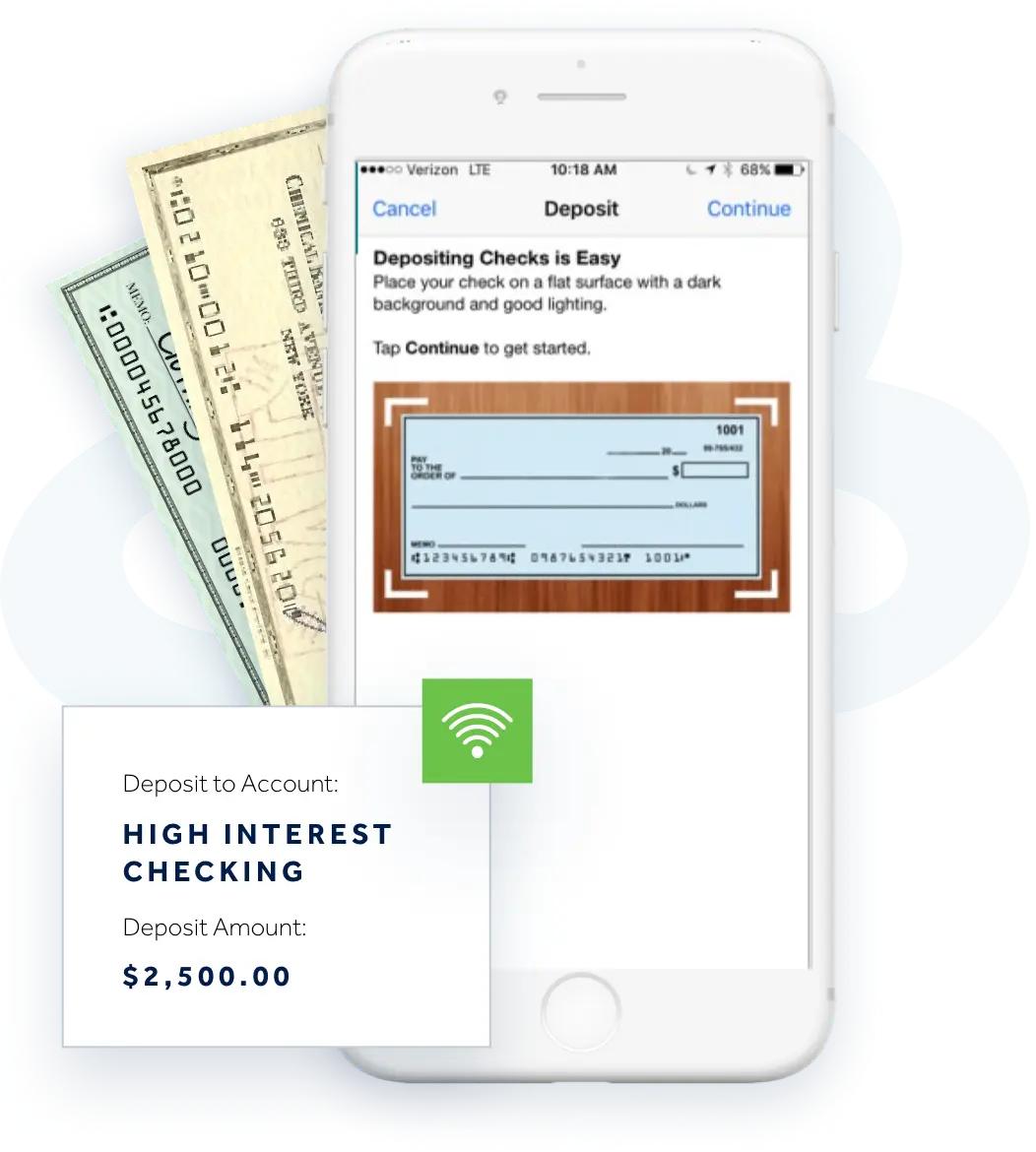

- Deposit checks with Mobile Deposit

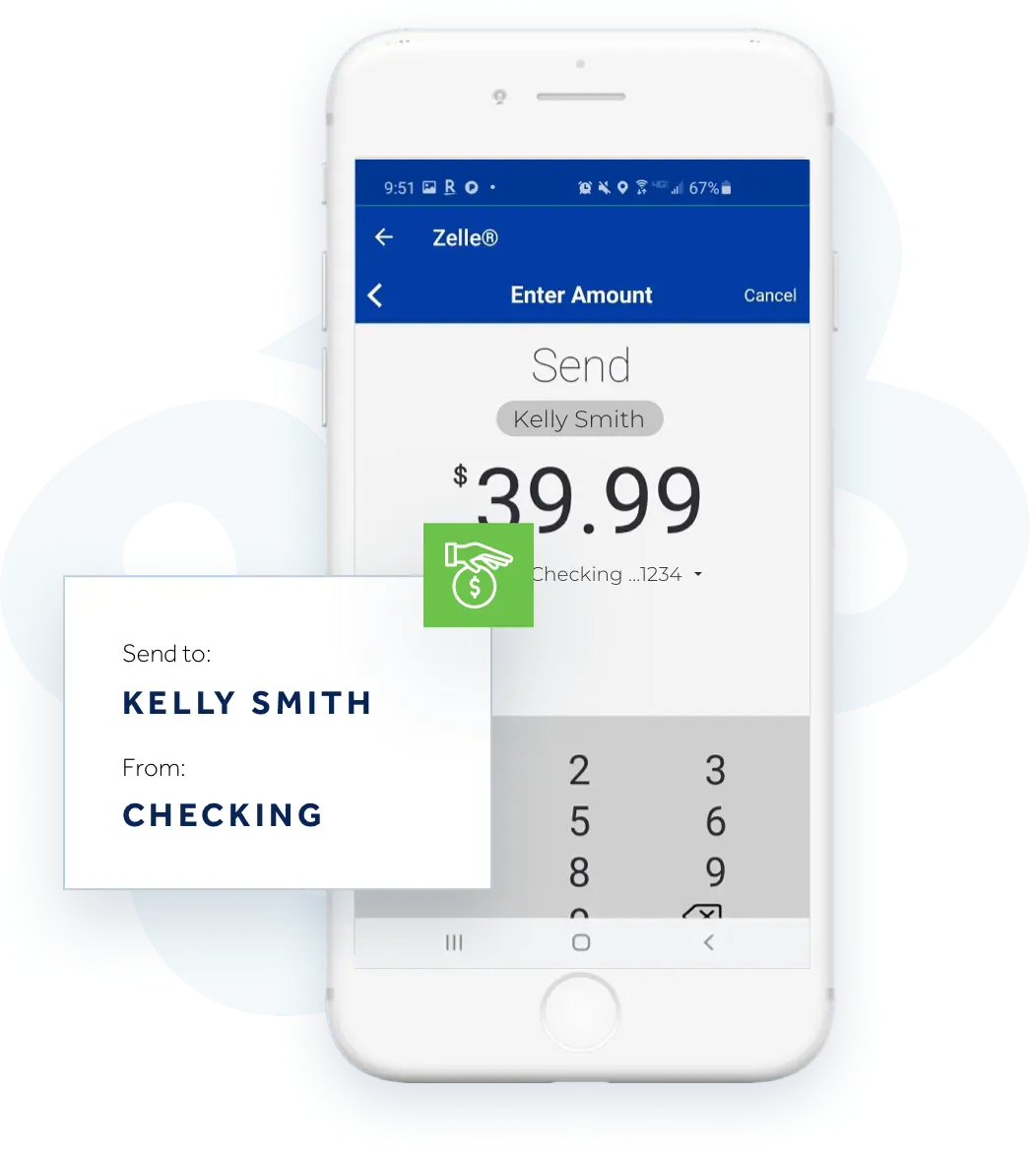

- Pay people with Zelle®

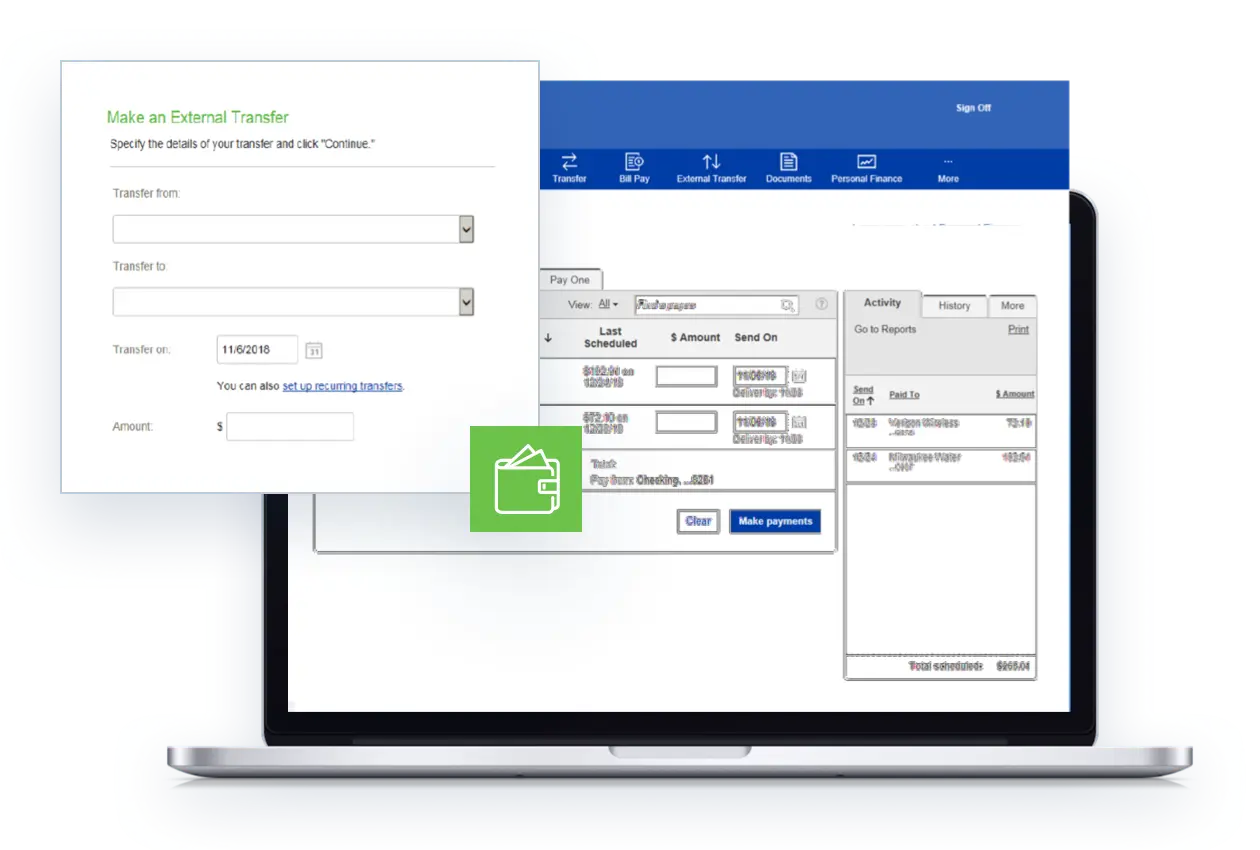

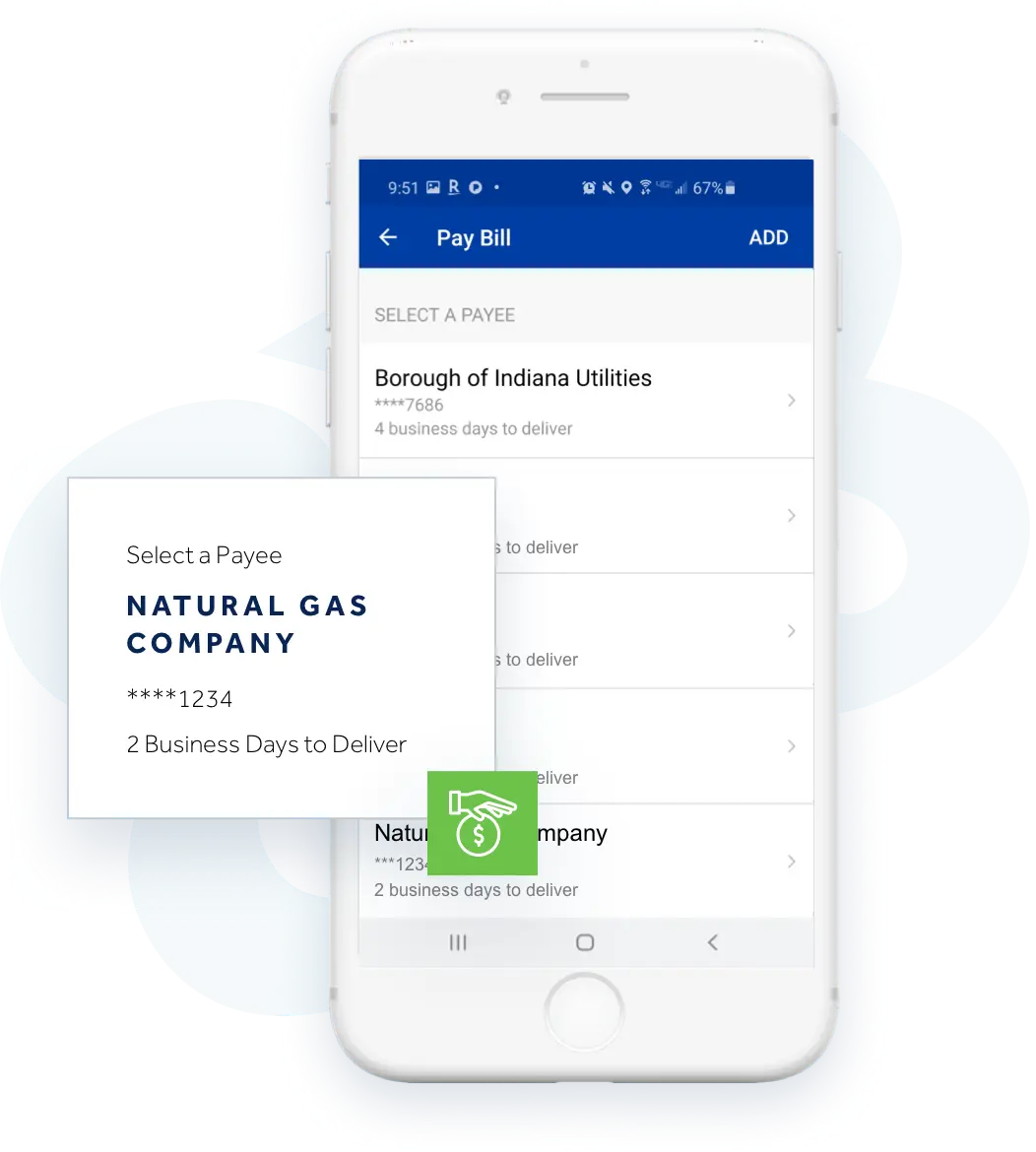

Payments Made Easy

S&T online banking gives you the convenient financial management you expect. Whether it’s secure transactions, simple online bill payments or money transfers, we make sure you money gets safely where it needs to go.

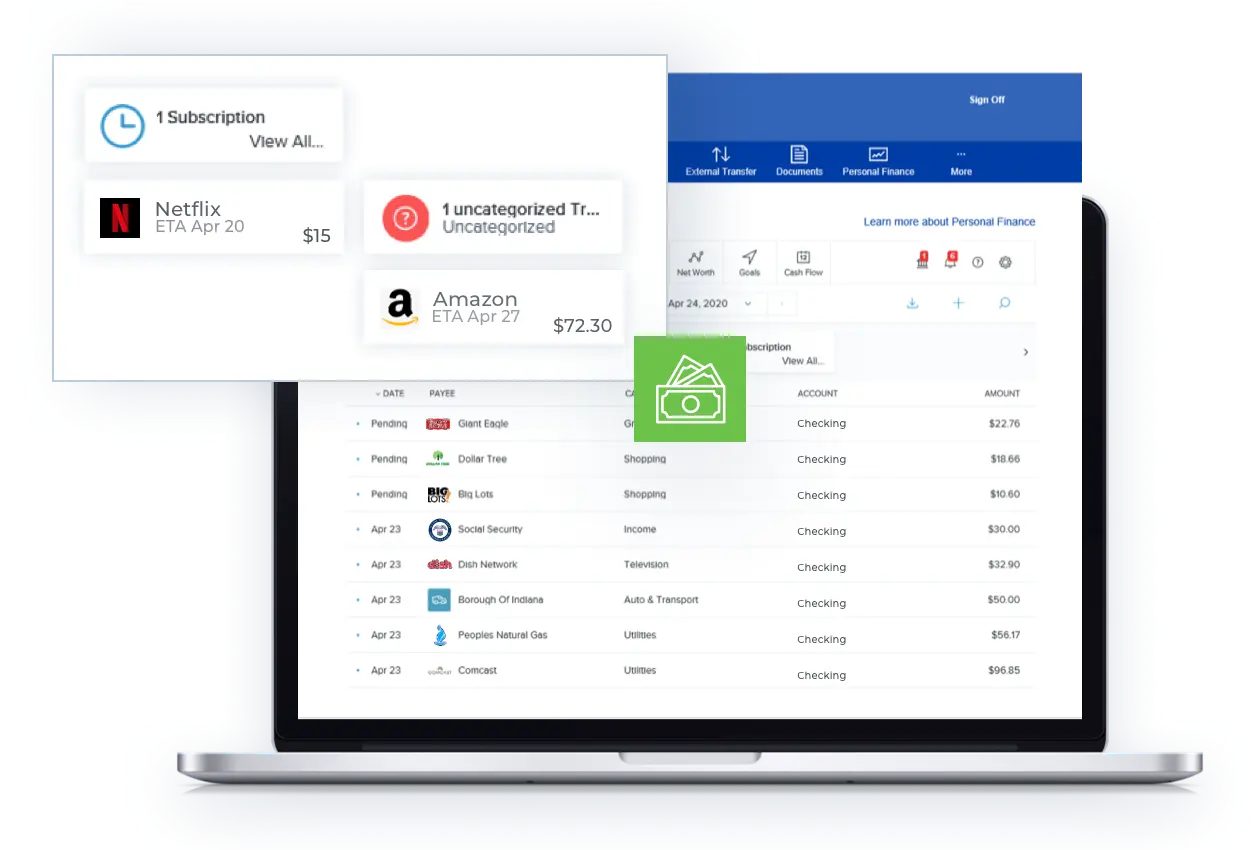

Keep Track of It All

Easily monitor your spending, balances and account activity from wherever you are. Your statements are always available and keep you in control by providing a detailed record of every transaction.

See the Big Picture

S&T offers you an online, streamlined, comprehensive way to manage your finances across accounts and financial institutions. Track, budget, report and organize your finances with our Personal Finance tool. You’ve got this.

Your Digital Wallet

In a hurry? Left your wallet at home? No problem. Pay for everyday purchases quickly and securely when you enable your S&T debit card through Apple Pay, Google Pay, and Samsung Pay. Just tap and go.

Your S&T Debit Card

With your S&T’s debit card, you have 24-hour, secure access to your funds at thousands of ATMs wherever you see Cirrus, NYCE or Visa symbols. Use your debit card to pay online and on the go with ease, convenience and peace of mind.

Banking for Wherever You Are

Pay, transfer, deposit and monitor your accounts with S&T Bank’s Mobile Banking App.

Banking for Wherever You Are

Pay, transfer, deposit and monitor your accounts with S&T Bank’s Mobile Banking App.

FAQs

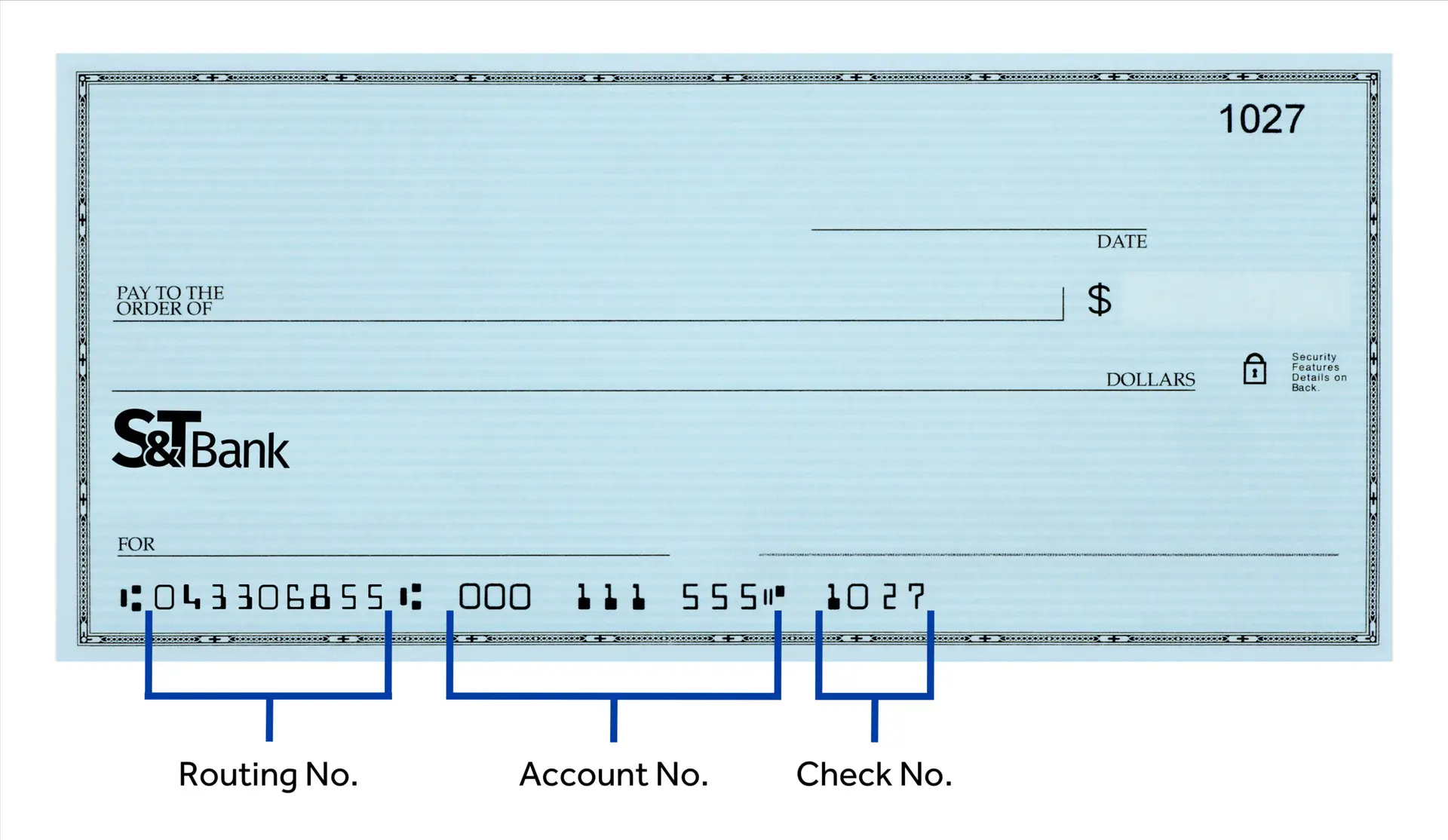

A checking account allows you to make deposits, withdrawals and fund transfers for day-to-day transactions. Money can be deposited into your account at a branch, ATM or using mobile deposit. You can easily utilize checks, debit cards and mobile wallet to make purchases or withdraw funds at an ATM or branch.

To open the account, you’ll need:

- Initial funds to deposit

- Driver’s license, state identification or US Passport

- Social Security Number

Reorder your personal checks online directly through Deluxe.

Yes, some checking accounts are eligible to earn interest.

Please view the consumer account opening requirements or business account opening requirements to learn about the documents you will need.

Financial Planning

Reach Your Financial Goals

Let our experienced team empower you to make financial decisions that can help shape your legacy.ClickSWITCH™

Make the Switch

allows you to easily switch accounts to S&T BankCareers

Join Our Team

join our team at S&T BankCommunity

Going Further Than Just Banking

see how S&T engages with our communities