Personal Finance Management

Achieving financial well-being is easy with S&T’s Personal Finance solution.

Personal Finance

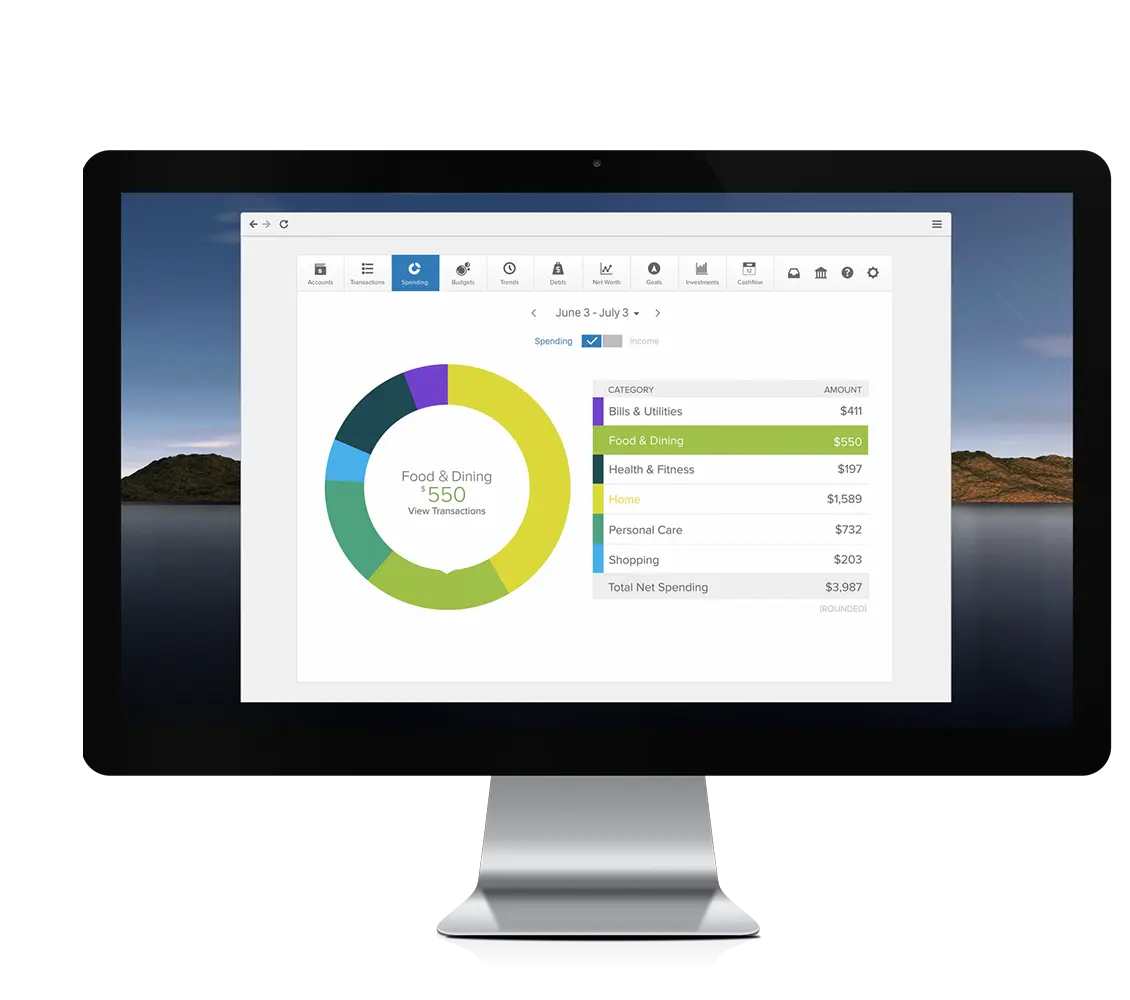

Having your finances under control is essential for achieving your goals and feeling secure. With S&T’s Personal Finance solution, you can track your expenses, savings and investments to easily manage your money from wherever you are. This solution will sync all finances, personal assets and accounts, including S&T and non-S&T accounts. It is a financial bulletin board that enables you to organize expenses, retirement accounts and investments and even manage budgets on behalf of others.

Get Started

- Log in to your S&T Online Banking account

- Click more

- Click Personal Finance

- View the disclosure and check the box to accept

- Click get started

- Once the page loads, your S&T Bank accounts will display

- Follow the prompts to customize your Personal Finance account

Not an online banking customer? Enroll today.

Personal Finance Overview

How can Personal Finance help you?

Set Goals

The Goals tool enables you to manage and visualize your goals on a timeline. You can create a goal, name it and associate it with an internal or external account. You can also change the amount and priority of each goal, as well as the total amount available overall.

Optimize Your Budget

The Budgets tool is a visualization of spending over time divided into categories. You can create custom

budget categories, adjust the amount allocated for the budget, view historical budgets and change projected income.Receive Alerts

The Alerts feature is a notification system that can send email messages to you based on your preferences. Set alerts for payment reminders, low account balances, large deposits, large expenses and more.

& when you're ready, S&T Bank offers these savings options:

Money Market

Savings with the flexibility of a checking account. Make unlimited over-the-counter transactions and enjoy a competitive yield on your savings.

My Choice Account

Similar to a premium holiday club savings account, but you decide when to use the money. Save for one year and choose your own disbursement date.

Premium Holiday Club

This automatic savings contribution is deducted from your S&T savings or checking. Don’t let the holidays catch you off guard-be ready to shop, not blow your budget!

Certificates of Deposit

Grow your savings with an FDIC insured account that has a fixed rate and no monthly fees.

Preferred Savings

A great choice for customers with a Preferred Checking account who are interested in higher yield savings.

Statement Savings

Easy to open, use and save. Have open access to your funds with a quarterly statement that keeps you informed and engaged.

Spending Insights reviews the spending data of S&T deposit accounts that are linked within online and mobile banking. Personal Finance can aggregate external account information to provide a complete financial picture.

You must enroll in Personal Finance within online banking before it is available to you in the mobile app.

The financial institution logos on this page represent some of the more commonly requested external account providers. To locate your external financial institution, you may simply type the name into the search box – it will usually autofill. If this isn’t successful, copy the login page URL from the direct financial institution site into the search box. Once your financial institution is located and added, the logo will normally appear beside the account on your accounts page.

The financial institution that you’re trying to add doesn’t recognize the aggregator requesting your account information (just like when you log in for the first time on a new or different device). To ensure security, it will require step-up authentication, which can include the code from a text message or answers to personal security questions.

Balances for external accounts are only updated once after nightly processing. Any intra-day transactions will not display or affect balances until the following business day.

Find the Services You Need

Spending Insights

Achieve Your Financial Goals

By using Spending Insights, you can access timely updates with your S&T accounts through transaction monitoring while viewing your daily cash flow and spending habits.

Learn more about spending insightsZelle®

Send and Receive Money

Get started by enrolling your email or U.S. mobile number through the S&T Bank mobile banking app.

Learn more about ZelleCustomer Service

Solution Center

Get connected with the help you need by phone, email or live chat.

Reach out for customer support