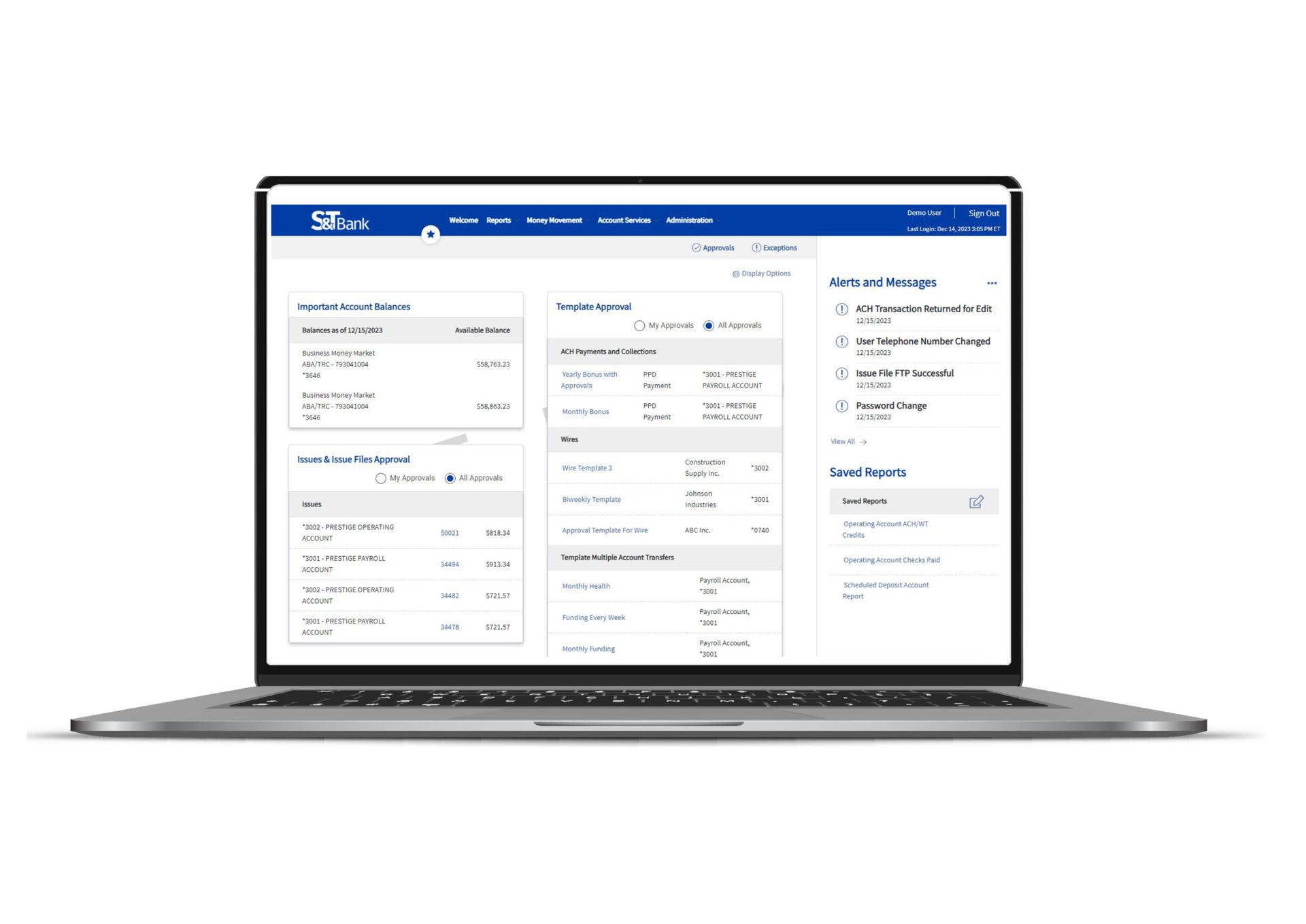

Introducing Treasury Advantage

A suite of business banking solutions designed for your business.

Fight Fraud and Protect Your Bottom Line With Positive Pay

Learn more about Positive Pay and how it helps prevent check fraud.

Treasury Advantage was designed with your business in mind. This valuable package combines the solutions you need to operate your business at a fixed and predictable price point. With solutions like Business Online Banking and Positive Pay, you’ll have the tools you need to manage your finances and protect against fraud.

The base package includes:

- Business Online Banking Premium

- Business Mobile Banking App

- Bill Pay

- Mobile Deposit Capture

- Discounted online wire origination

- Customizable access for multiple users

- Access up to ten deposit accounts

- Token passcode authentication

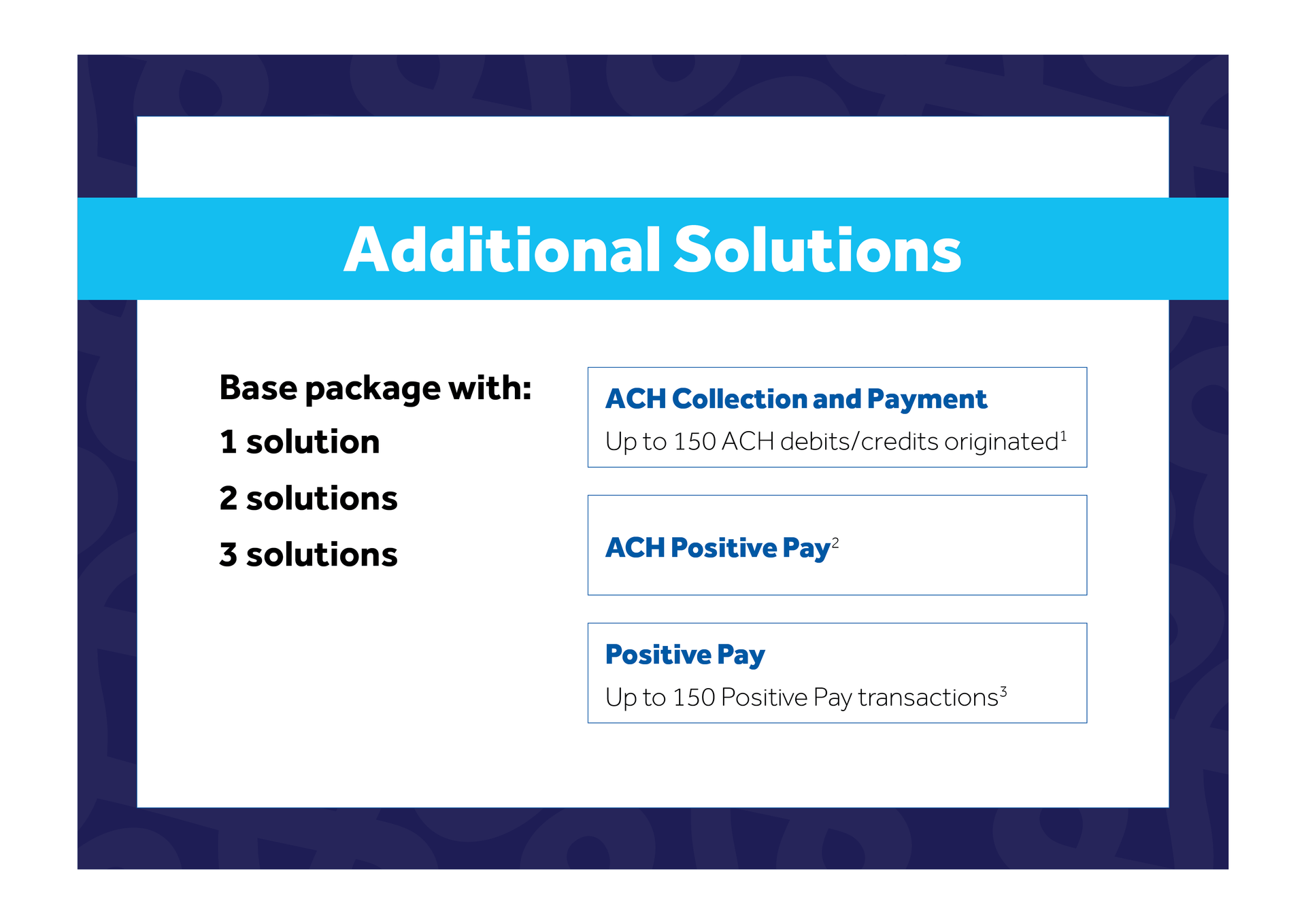

The choice is yours!

You can add additional solutions to your base package. Select the services that you need.

Remote Deposit Capture

Save time by depositing your business’s checks directly into your S&T account anytime with a simple check scan from your office, or anywhere you have access to a scanner and the internet. Deposits made prior to 8 p.m. EST are available next business day.*

ACH Collection

Increase efficiency by automatically collecting regularly scheduled, recurring payments from your customers. S&T debits the paying account and credits your account the same day.

Positive Pay

Positive Pay is one of the most effective deterrents to check fraud and can help you minimize loss by monitoring and detecting potentially fraudulent checks.

Wire Transfer

Improve cash flow forecasting and send payments either same-day or on a future, scheduled date. All wire transfers are made securely by S&T, so you can trust that your funds are secure.

ACH Processing

ACH is a simple, quick and secure way to pay employees, and service providers electronically while eliminating the costs and time constraints associated with manual payment processes.

*Deposits made prior to 8 p.m. EST have next-business-day availability. All Remote Deposit Items are subject to the requirements of the Bank’s Funds Availability Policy. The Bank’s Funds Availability Policy can be obtained at any branch office, or you may call 800-325-2265.

1Per item fee of $0.25 will be charged after 150 items are exceeded in a month.

2Includes the ACH Positive Pay solution for one deposit account. Additional accounts can be covered with ACH Positive Pay for a monthly

fee of $5.00 per deposit account.

3Includes the Positive Pay solution for one account. Additional accounts can be covered with Positive Pay for a monthly fee of $15.00 per deposit account. All accounts utilizing Positive Pay have a collective limit of 150 transactions (checks) per month. A per item fee of $0.25 will be charged after 150 transactions.